In response to many requests for information, we decided to write a short report that can provide you with a quick heads-up and figures of interest to understand the state of the international peanut market from our point of view.

We also opted to include information related to the current weather situation and extended weather forecasts that could definitely shape up the beginning of the season 2020/2021 in Argentina, especially during the plantings stage.

This report is based on our direct experience as well as comments of other origins received by trusted sources.

Peanut Market Highlights &

Weather expectations

Peanut Market

Supply and Demand – Crop 2019/2020

The latest figures reported by the Argentina Peanut Chamber (CAM) are presented below:

The main take-away is that peanut production has been very good amid good yields, despite the sharp decrease in the planted area YOY.

From a quality standpoint, the new crop showcases outstanding results given by unparalleled weather conditions at the time of digging and harvesting. Total exports of peanuts (kernel basis) are forecasted at approximately 580k metric tons.

Our own estimation, based on the harvested area reported by the CAM, is a bit more optimistic since it considers slightly higher yields, and places total exports at 606k MT approximately for the current season.

Exports by type of product

The evolution of the exports from Argentina by HS code throughout the last 8 years is presented below:

Blanched peanuts are the top exported products from Argentina, totaling around 50 – 70% of the global exports, followed by raw wholes, raw splits, and roasted peanuts.

In years in which quality is not optimal, the share of blanched peanuts tends to increase in detriment of raw peanuts.

The second take-away from this chart is that roasted peanuts are slowly but consistently increasing their participation in the total exports.

In the chart below, exports from Argentina from June 2016 up to now are presented (monthly basis).

All exported products experience a sharp decrease every year around May, which is coincident with the end of the peanut season in Argentina. This means that Argentina usually sells its entire production every year, so there’s a null carryover to the next season.

The decrease in May 2020 was less considerable than previous years though. The fact that the new crop was harvested at record pace granted the opportunity to continue shipping containers without experiencing a major bump.

Exports by destination

The European Union is the most important destination for Argentine peanuts. Rotterdam is, by far, the most important point of entry for Argentine peanuts.

Two tables are presented below. The first one shows exported quantities of raw peanuts for Crop 2018-2019, whereas the second table presents the same information for blanched peanuts.

Exports Argentina by destination – Raw peanuts – Crop 2019 (June 2019 – May 2020)

Exports Argentina by destination – BL peanuts – Crop 2019 (June 2019 – May 2020)

On the other hand, the first 2 months of the Crop 2019-2020 show a similar pattern in the destination of the exports (provisional numbers subject to future adjustments).

Exports Argentina by destination – Raw peanuts – Crop 2020 (June 2020 – July 2020)

Exports Argentina by destination – BL peanuts – Crop 2020 (June 2020 – July 2020)

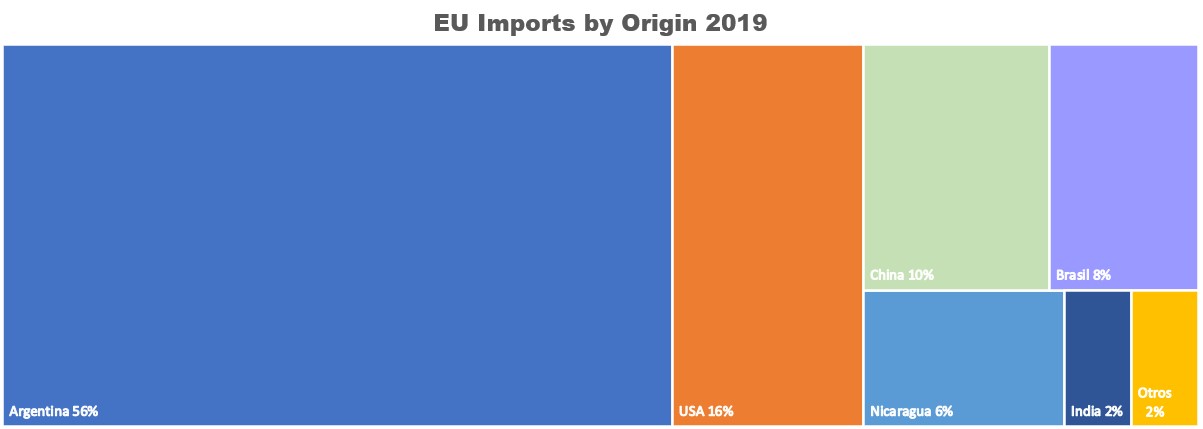

As the European Union represents the most important destination of Argentine peanuts, Argentina also represents the most importan sourcing origin for the EU, creating a mutual dependency of one with the other. The market share of EU imports for peanuts is presented below.

Argentina covers more than 50% of all the peanuts exported to the EU, followed by USA, China and Brazil. This trend has been stable throughout the last years. Imports by origin for 2018 can be seen below.

There are not updated statistics from EU due to the Covid19 pandemic, but our estimation is that the market share of Argentina will grow to more than 65% during the present season.

WEATHER: CURRENT SITUATION & EXPECTATIONS

The soils in the main agricultural area of Argentina are currently experiencing significant dry conditions. After many months without rains, there’s a marked water deficit that could hinder the projected planting tasks, to be carried out in October/November. Although there’s still a few months to go, it’s imperative to follow the evolution of this metric closely, since it could affect current markets.

The map below shows the rains situation in the province of Cordoba thru August 2020. All departments show rain levels below historical records for this time of the year.

It’s important to take a look at the extended weather forecasts in order to understand what’s to come in the next season.

Based on the statistics generated by the International Research Institute for Climate and Society from Columbia University, probability favors the occurrence of “La Niña” phenomena towards the end of 2020, which is characterized by scarce rains, below historical averages. Should that forecast materialize, the new season’s kick off in Argentina could be in trouble.

A continuation of the drought conditions described before could definitely influence the current market.

In the below chart, it can be seen that the probability of La Niña is specially high for SON (September, October, November), OND, NDJ and DJF.

As we enter the new year, a shift to more neutral conditions is expected.

FINAL COMMENTS

The international market for peanuts remains without major activity, mainly from the demand side. This stillness has resulted in a drop in prices globally. At this point of time, it is certain that we are going through a totally atypical year as a result of the Covid19 pandemic. Globally, there is a marked uncertainty about the future, which makes all market players operate very cautiously. Nobody seems to be willing to make large and long commitments without a clear picture of what’s to come. The market stillness my also be explained by the fact that the northern hemisphere is on summer vacation periods, which usually translates into a seasonal decline in business. In our opinion, Argentina is likely sold at around 65 to 70% of the entire crop.

In the last few months, Brazil has shipped a big volume in a very short time. Russia and Algeria, their two main markets, were eagerly waiting for the new crop due to deferred contracts from the previous year. Argentina, on the other hand, has not decreased shipments during the last months of the previous season, which is a typical effect of the end of harvest. This anomaly speaks of the existence of a carry over. It’s worth noting that the harvesting tasks corresponding to the new crop were finished very quickly, which helped ensure a continuation in supply.

The good seasons in the southern hemisphere have given global buyers peace of mind, as well as the prospect of a decent new crop in the USA, leaving behind one of the worst American crops in recent memory.

During July 2020, the first edition of the World Peanut Meeting was held. Some of the most interesting take-aways from the event were:

- The representative of India did not rule out that India could become a net importer of peanuts. This could generate a very strong structural change in the market in the medium term.

- China also had a significant participation in the international market, setting a new record for imports. An old prediction that at some point China would become a net importer seems to be near. It is necessary to follow the evolution of its imports to clarify if it was an exceptional situation or if it is sustainable over time.

- The USA has been able to get rid of a very good part of its bad crop by sending it to China.

- Very high interdependence between the EU – Argentina. Very high interdependence Brazil – (Russia + Algeria). Very high interdependence USA – (Domestic market + Canada + Mexico). China, for its part, gives priority to African countries (Senegal and Sudan) for its procurement, and in second place to India and the USA, while Argentina’s participation in China is only for certain niches.

- Sudan has just informed that peanut exports are forbidden in order to generate greater added value in origin. We do not believe it is sustainable, but in the short term it may affect Chinese imports.

- The dollar has been devalued against other strong currencies, such as the Euro, giving European buyers greater purchasing power.

- We believe that prices are getting close to the bottom level. Nevertheless, as we move to a new stage related to weather conditions and plantings in the south hemisphere, the market trend cound change according to its evolution.

Do you have a commercial inquiry?

Request for price quote

Other questions or comments?

Contact us: stembras@gastaldihnos.com.ar

Follow Gastaldi on social media: